The assistant district attorney declared in a summation that Trump-sanctioned tax fraud

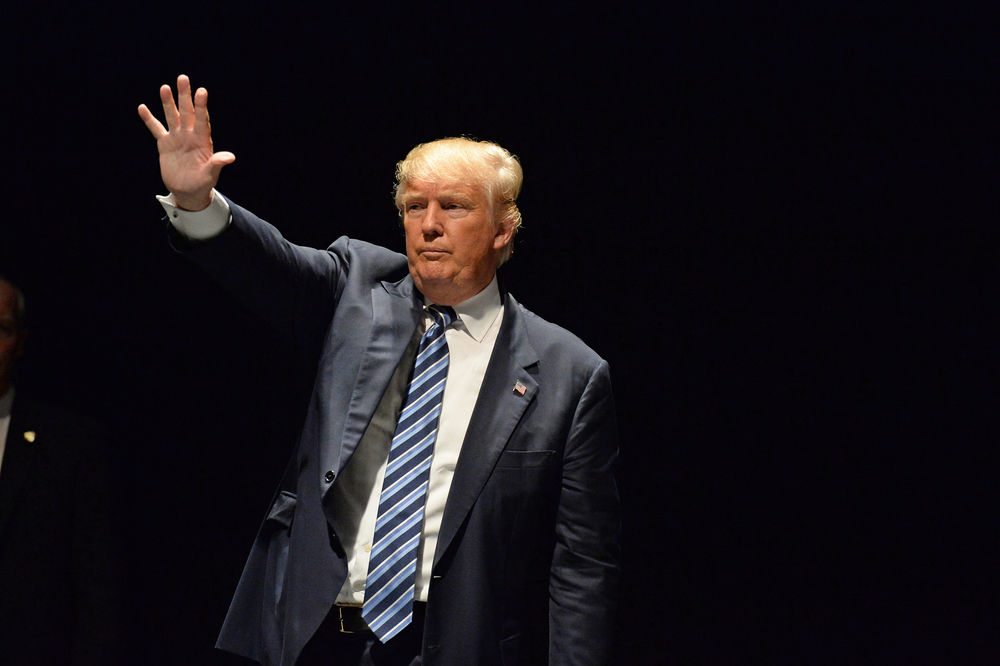

Trump Corporation attorney Susan Necheles stated to the jurors that the trial isn’t a referendum on Trump, and asked them to keep their minds open. Both sides put emphasis on the fact that Trump wasn’t the defendant, however, it seems that the former president’s name came up a lot.

However, some of the most interesting evidence presented to the jury was no less than the documents with Trump’s signature, which included a rental agreement for a luxury apartment used by Weisselberg, and a private school tuition check made for a grandchild of Weisselberg’s.

Weisselberg admitted that he didn’t declare any of those benefits as income, even if it was required by law. In his summation, Joshua Steinglass, the current assistant district attorney, decided to point a rhetorical finger right at Trump, adding that Trump sanctioned tax fraud.

The defense immediately objected, and the objection was sustained by the judge. During the trial, Trump was still running for president, while vigorously lambasting Manhattan District Attorney Bragg on social media.

Also, Weisselberg pleaded guilty to 15 felony tax charges. He also admitted that he hid the part of his salary that was “paid” through untaxed benefits, such as a luxury apartment, a Mercedes-Benz lease for him and his partner, and private school tuition for his grandkids.