5 Lessons Biden Should Learn From Carter’s Presidency

When the consumer sentiment, mixed with small business confidence, hit its all-time low even worse than what we’ve been through in the midst of a pandemic or a deep recession, something is clearly off. Well, that’s exactly where we stand now, according to the University of Michigan and the NFIB, which is in charge of tracking the nation’s mood.

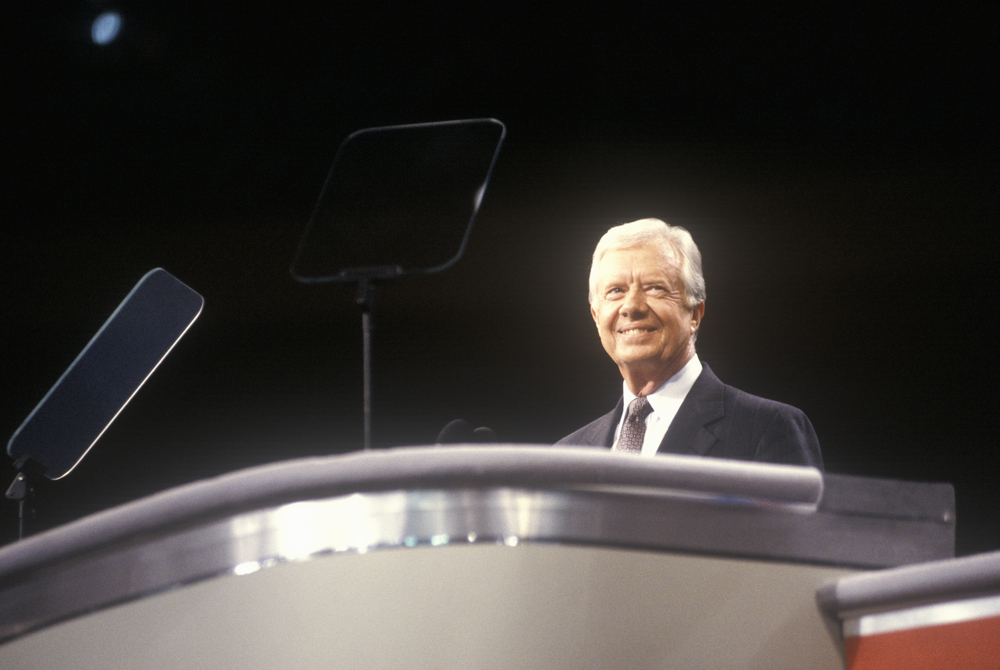

Naturally, we can’t help ourselves to start drawing all these parallels between Joe Biden’s approach in the office and Carter’s presidency. During their terms, they both seem to have a couple of things in common, such as soaring inflation, a looming recession, international crises and energy shortage, just to start with. So we can’t help but wonder…is there something Biden could learn from Carter’s presidency? Let’s see!

Lesson One

Probably the first thing that should be mentioned is the critical importance of energy independence. Right after the 1979 revolution in Iran, there was a sudden dip in global production that tightened markets, the same way it happens now because of the war in Ukraine, which has cut all Russian oil exports.

OPEC raised their prices with 9% in 1979, which naturally led to higher gasoline prices for all Americans and unhappy voters altogether. However, the vulnerability we’re facing now stemmed partly from the fact that domestic production is declining.

As Carter said, “In less than two decades we have gone from a position of energy independence to the one in which half the oil we need comes from foreign countries, and their prices are going through the roof.

Our excessive dependence on OPEC has already taken an enormous toll..” But two years ago, we were energy independent for the very first time since 1957, but the pandemic and Biden’s war on fossil fuels only led U.S. production to slump, not to mention the upward price pressures on oil.

Second Lesson

What about the danger of price controls? Richard Nixon was the one to impose widespread wage-price controls that started in August 1971. Then, the price of domestically-produced crude oil was decided by the federal government, and it was below the price that was charged on imports.

When Carter lifted the price controls in April 1979, all the oil companies were paid with $9.65 a barrel on average, while imports were more expensive, at $16. You can only imagine that this decision sank U.S. production.

In December 1970, a year before controls were imposed, the U.S. produced 10 million barrels/a day for oil, a level that hasn’t been reached again until 2017, when higher prices and new technologies boosted the output.

Biden came with approval ratings on managing the economy came with poor performance, and is now tempted to impose new controls on oil prices. That, as you can figure, would be a huge mistake.