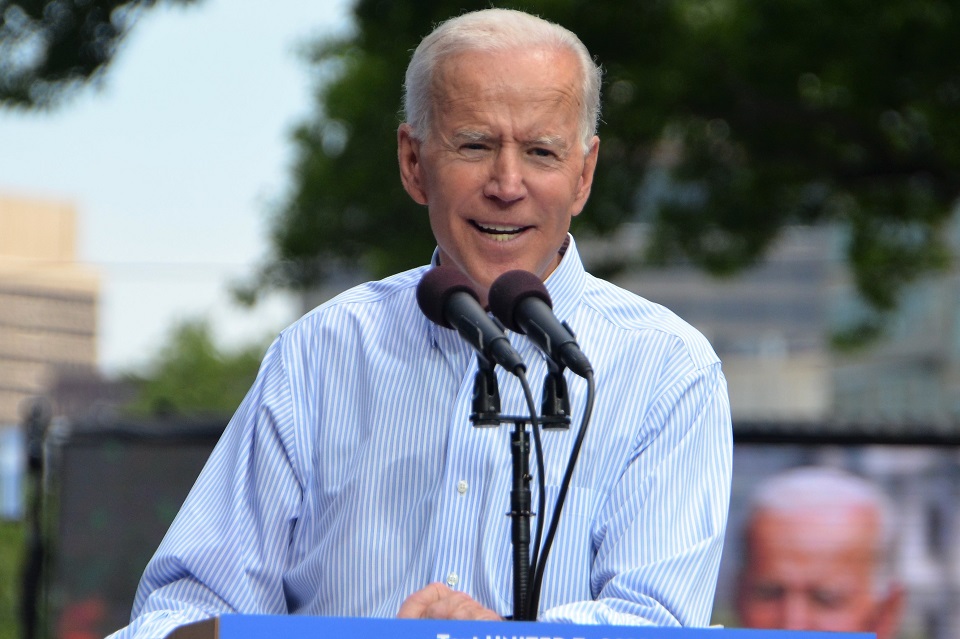

President Joe Biden sat down for an ABC News interview with George Stephanopoulos, which was aired on March 17, to outline his plans to follow-up to his pandemic-relief bill, the $1.9 trillion COVID-19 stimulus act, with a more long term economic program designed not only to fund key initiatives like infrastructure and the fight against climate change but to focus his attention on providing some of the poorest Americans with some much needed help.

And while the plan is both noble and welcomed, the message he delivered seems to have needed some immediate clarification. During the interview, Biden appeared to suggest that the tax-hike threshold would be $400,000 in individual income and anyone earning above that figure would see a ‘small to a significant tax increase’.

However, later on the same day the interview hit the airwaves, White House Press Secretary Jen Psaki would take to the podium at her daily press briefing to clarify that the proposed tax increases applies to “families” rather than individuals, meaning that people who earn $200,000 per year if they are married to someone who makes the amount.

Although this clarification greatly reduces the tax-hike the President announced, this is just the start of a whole suite of tax increases that Biden proposed during the race for the White House in last year’s election.

Whilst nothing has been announced officially, a repeal of portions of Trump’s 2017 tax law that benefited corporations and wealthy individuals certainly seems likely to be the first item on his desk.

An independent analysis by the Tax Policy Center of the tax restructuring put forward in Biden’s Presidential campaign estimates that over the next decade, the increases he suggested could add $2.1 trillion to the country’s coffers, but other analysts think that figure could go up to as much as $4 trillion.

He clearly wants to set his sights on the small percentage of American’s who possess a large percentage of the wealth in the country and addressing the financial inequality that has been growing in society for the last few decades.

To say the President will face steep opposition would be a massive understatement. The reason nothing of great import has happened in the tax arena since Bill Clinton’s signature tax overhaul, the Omnibus Budget Reconciliation Act of 1993, is due to Republicans meeting any such reforms with uniform opposition.

History is likely to repeat itself with the modifications to the tax system Biden has spoken off wanting to push through.

While nothing is set in stone just yet, many of the proposals currently planned or under consideration have managed to slip under the door of 1600 Pennsylvania Avenue and out into the public domain. The changes likely to happen are:

– Raising the corporate tax rate to 28% from 21%,

– Paring back tax preferences for so-called pass-through businesses, such as limited liability companies or partnerships,

– Expanding the estate tax’s reach,

– A higher capital gains tax rate for individuals earning at least $1 million annually.

Other less certain proposals could find their way onto the Resolute Desk, such as more money for Internal Revenue Service enforcement to target more people who seem to think the country’s tax laws just don’t apply to them.

One plan that might reach across the aisle is a revision of tax laws to provide incentives to U.S. companies in order to stop them from shifting jobs and profits offshore, however, imposing penalties on said companies would likely meet resistance from Republicans.

Whatever President Biden plans to do regarding the state of the nations tax laws, the addressing of wealth inequality in the United States is long overdue as a recent analysis conducted by the Institute for Policy Studies showed that the combined wealth of all U.S. billionaires increased by 39% ($1.138 trillion) between March 18, 2020, and January 18, 2021.

RELATED POST: Biden Lays Out His American Future